Tracking Your Portfolio

Learn how to track and monitor your portfolio performance

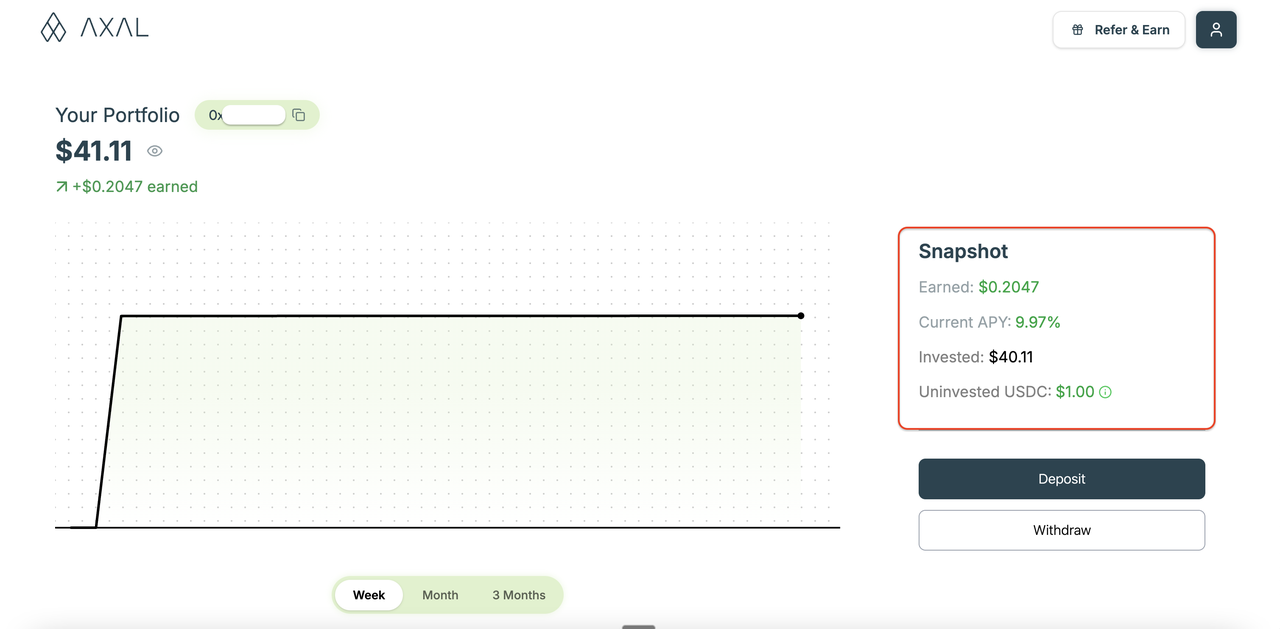

Your dashboard provides real-time insights into your overall performance and positions. The top section contains a snapshot card with key, at‑a‑glance metrics.

Snapshot Card

Section titled “Snapshot Card”

- Earned: Your total earned amount of money.

- Last 7D APY: The trailing 7‑day annualized yield, updated daily. This smooths out day‑to‑day noise while reflecting recent performance.

- Current APY: How much is your money earning at this very moment?

- Invested: The amount of money earning yield at the moment in position.

- Uninvested USDC: Total idle balance not currently allocated to strategies. You can click “Deposit” to put this to work.

Graphs & Visualizations

Section titled “Graphs & Visualizations”- Performance Over Time: Line chart of account value and benchmark comparisons.

- APY Trend: Rolling 7‑day APY series to track consistency and momentum.

- Allocation by Strategy: Donut or stacked chart showing how capital is distributed.

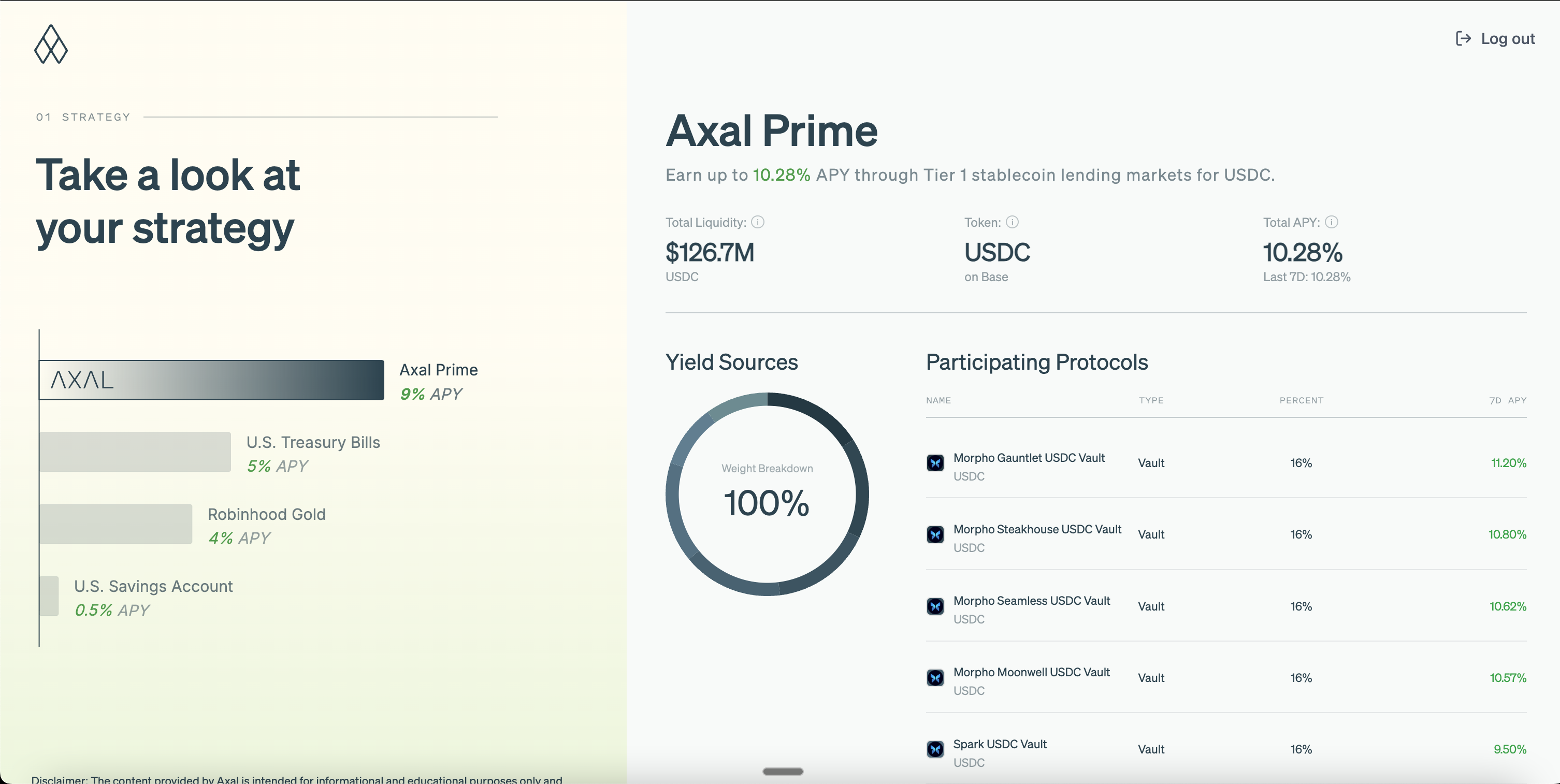

Strategy Page Deep‑Dive

Section titled “Strategy Page Deep‑Dive”

From the dashboard, open the Strategy page at axal.com/strategy to see:

- Current strategies in use and target/actual allocations.

- Protocol‑level positions (e.g., Morpho, Euler, Yo) and network distribution.

Key Metrics

Section titled “Key Metrics”-

Total Value: The total worth of your portfolio at any given time, including your deposits and returns. This is like checking the balance in your savings account, which shows both what you deposited and the interest you have earned so far.

-

APY (Annual Percentage Yield): The projected yearly return on your funds, including the effect of compounding. It tells you how much your money could grow over a year if left in the account. This is the same as the interest rate your bank advertises for a savings account, except Axal’s APY is actively optimized to be higher.

-

Total Earnings: The cumulative amount of returns your portfolio has generated since you first deposited. This is like looking at the total interest your savings account has paid you over time, separate from your original deposits.

Good Practices for Monitoring Performance

Section titled “Good Practices for Monitoring Performance”- Check Weekly: Review the snapshot card each week and compare the Last 7D APY to prior periods.

- Watch Uninvested Cash: Keep a small buffer for upcoming withdrawals, but minimize idle amounts to avoid cash drag.

- Validate Allocations: Ensure your allocation by strategy matches your risk tolerance and investment horizon.

- Drill Into Strategies: Use the Strategy page to confirm protocol health and understand sources of yield.

- Compare to Benchmarks: Track your performance against simple baselines (e.g., stablecoin lending APY) to contextualize results.

- Review Events: Check the block explorer for deposits, withdrawals, and rebalances that impact returns.